Insurance Commission pays out $391m to help those injured on WA roads

20 September 2018

- 12,000 new motor injury insurance claims made in 2018

- WA drivers pay one the most affordable motor injury insurance and registration rates in Australia

The Insurance Commission paid out around $391 million in 2018 to help those injured on Western Australian roads.

In the 2017-18 financial year, the Insurance Commission received 11,818 new motor injury insurance claims, comprising of 3,191 Compulsory Third Party (CTP) compensation, 8,588 CTP minor injury and 39 Catastrophic Injuries Support scheme claims.

Overall, the Insurance Commission managed motor injury claims valued at nearly

$2.8 billion with anticipated future claims expenses of $2.4 billion. It provides motor injury insurance to 1.8 million drivers and their 2.9 million registered vehicles in WA.

Rod Whithear, Insurance Commission Chief Executive, said: “I am pleased to report the total number of new Compulsory Third Party compensation claims received in 2018 was 179 fewer than the 3,370 claims received in 2017. Fewer claims received means fewer people have been injured on our roads, which is the best outcome for all parties. Fewer claims also means less pressure on insurance premium increases.”

Claims payment amounts for large claims were lower than expected during the year, which contributed to a $71 million reduction in claims payments from the $462 million paid out in 2017.

Crash claims

The South West region of WA had the most new claims (1,118) outside of the metropolitan area, costing over $30 million in payments to those injured in car crashes. Metropolitan WA had the most number of claims (9,337) with a cost totalling

$293.5 million.

The most common injury type for motor injury insurance claims was spine and neck injuries totalling $111.5 million in payments followed by upper limbs ($52.6 million) and lower limbs ($66.8 million).

Rod Whithear comments: “Motor injury insurance claims involve a range of costs paid to help a person recover and return back to work following a car crash. It is therefore no surprise that the largest proportion of our costs is for health and disability services. “During 2018, we paid for almost 100,000 physiotherapy and doctor visits for people injured in crashes.”

To improve customer service, the Insurance Commission established a long-duration claims settlement team during the year to reduce the average time for all claims to be finalised. At the start of 2018, there were almost 400 CTP compensation claims that remained open from 2014 or earlier and the new team finalised 40 of those within the first two months.

Motor insurance affordability

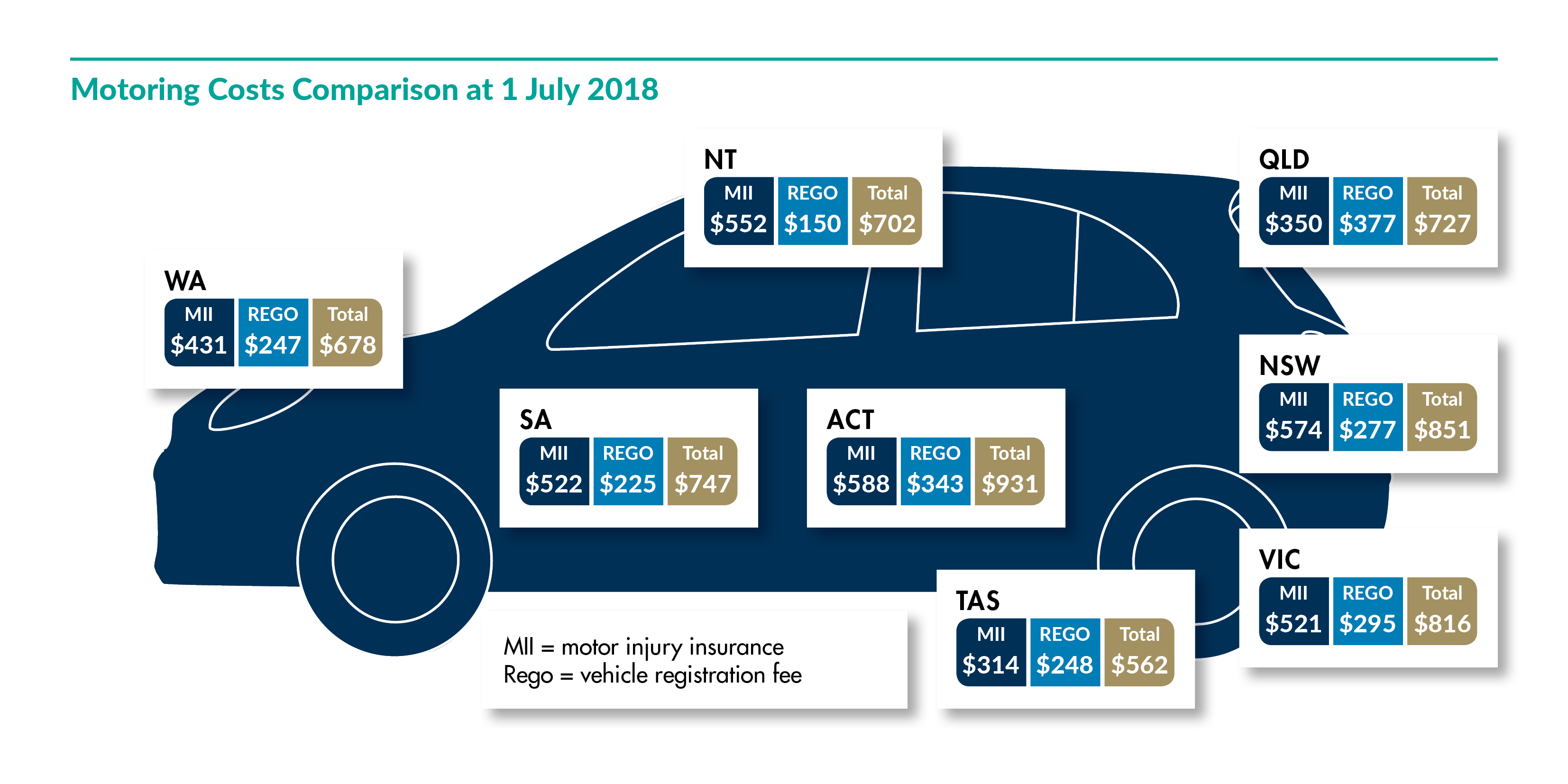

Despite the high costs paid for crash injuries in Western Australia, the motor injury insurance and vehicle registration costs for WA drivers ($678 for a small family vehicle) remains the second lowest in Australia compared to Australian Capital Territory ($931), New South Wales ($851), Victoria ($816), South Australia ($747), Queensland ($727) and Northern Territory ($702).

The motor injury insurance premium in WA ($431 for a family vehicle) includes no-fault lifetime care cover for catastrophic injuries from a crash after 1 July 2016.

For further information download the media statement.

Media contact

Wendy Vu

Communications Officer

+61 8 9264 3652

wendy.vu@icwa.wa.gov.au