Claims process

Claims management

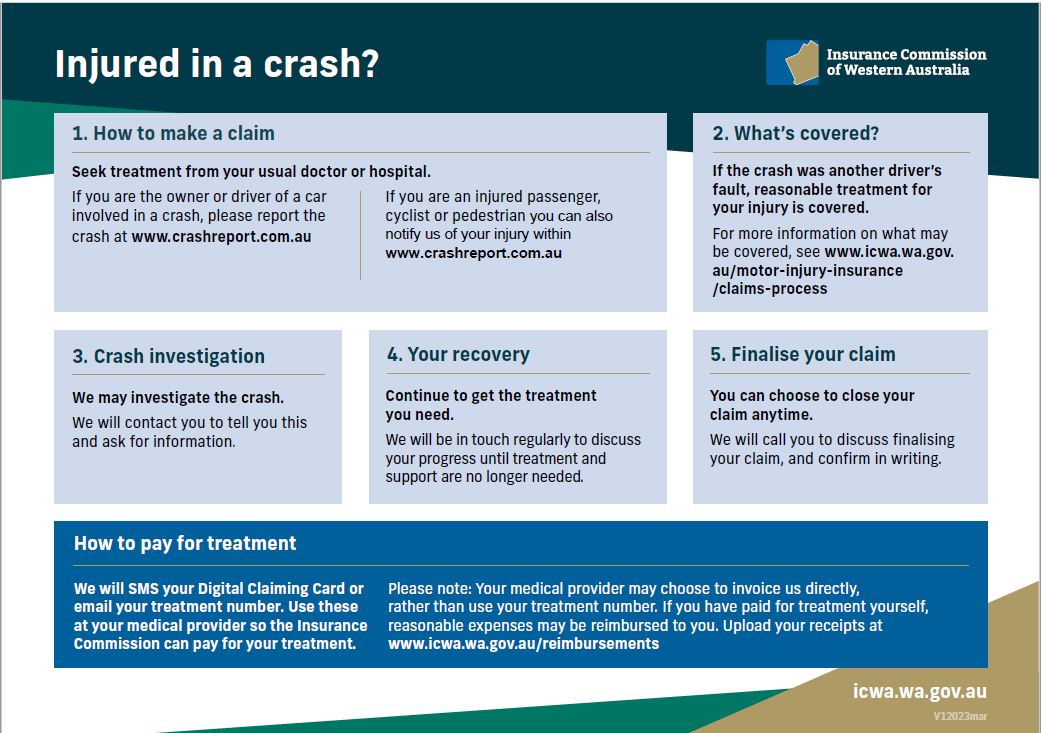

Once we review your information, we will make a treatment approval decision. We will call you to advise you of that decision. If approved, we will send you a text message with a treatment number so you can go and get treatment. We will follow-up with you regularly to check on your recovery, and may approve further treatment if required.

When dealing with the Insurance Commission you are required to:

- provide honest and factual information (or you might be breaking the law) - penalties and fraud information;

- complete and return required forms; and

- attend medical examinations and any settlement conferences as required.

We will also advise you of our decision on liability as part of our claims management process.

Your claim can be finalised at your request or once we receive a medical report confirming the nature of your injuries and your recovery.

When finalising your claim you may need to reimburse Medicare for any benefits it paid for your crash related injuries. To learn more about your Medicare repayment responsibilities, click here.

Do I need a lawyer?

You can lodge your claim and deal directly with us if you wish. If your claim is complex or disputed, it may be in your best interests to seek advice from a lawyer. You may choose to seek legal advice at any stage of the claims process. If your claim involves a child or person with a disability, there are some circumstances where a lawyer must be engaged.

If your injuries are not covered under the motor vehicle injury insurance policy, you may wish to engage a lawyer to advise you whether there are other avenues available to you to seek care and/or compensation for your injuries. For example, you may be able to make a claim under workers’ compensation, a liability claim against a third party, or a claim under a total and permanent disability insurance or personal accident insurance policy via your superannuation fund or employer.

If you have legal representation for your claim, we copy you in to correspondence made with your lawyer.

This fact sheet may be useful if you decide to engage a lawyer for your motor vehicle injury insurance claim. It provides information about your rights and proposes some questions to ask.

Dependency claims

If you have lost a close relative in a vehicle crash and were dependent on their financial support or the services provided by that person, you may be able to make a dependency claim under the Fatal Accidents Act 1959.

A close relative is:

- a spouse;

- de facto partner (having lived together on that basis for two years prior to the crash);

- biological or adopted child, step-child, grandchild;

- parent, step-parent, grandparent

- Brother, sister, half-brother or half-sister of the person who was fatally injured.

A close relative also includes:

- a former spouse or de facto partner whom the fatally injured person was legally responsible to financially support;

- a person who was legally responsible for the fatally injured person;

- a person for whom the fatally injured person was legally responsible.

You may be able to claim:

- funeral and headstone expenses in line with the WorkCover rate

- loss of financial benefit provided by the fatally injured person; and

- loss of services provided by the fatally injured person.

In most cases, you must lodge dependency claims within three years of the date the fatally injured person died.